From Mortgages to Markets: Unlocking Value Post-BOE Cut

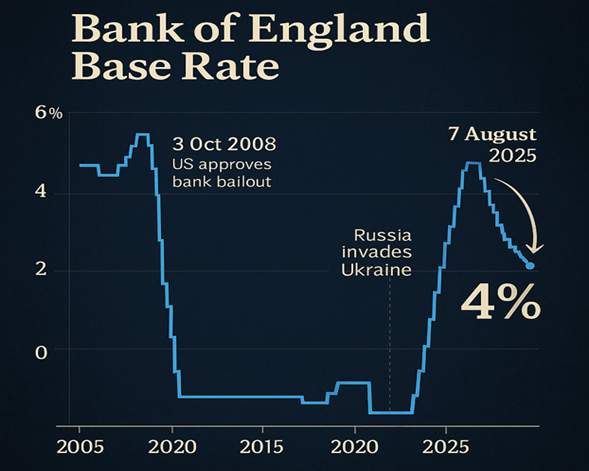

The Bank of England has lowered its base rate to 4%, a move that may reduce returns for certain savers. However, homeowners with tracker mortgages are set to gain instantly from the cut.

UK Interest Rate Cut: What It Means for Mortgages and Savings

The Bank of England has lowered its base rate from 4.25% to 4% — the fifth cut in the past year — returning it to the level last seen in March 2023.

Will your mortgage payments fall?

For most homeowners, the answer is no. Around 85% of the UK’s 8.4 million residential mortgages are fixed rate, meaning monthly repayments remain unchanged despite the rate cut.

However, roughly 590,000 borrowers with base-rate tracker mortgages will see an immediate benefit. Their interest rate will drop in line with the Bank’s move, and UK Finance estimates that someone with an average outstanding balance of just under £140,000 will pay about £28.97 less each month.

For the 540,000 borrowers on a lender’s standard variable rate (SVR), the outcome is less certain. Lenders often follow base rate changes, but they are under no obligation to do so. If they pass on the cut in full, a typical borrower could save around £13.87 per month, though the amounts vary because SVR balances tend to be smaller.

Looking ahead, about 900,000 fixed-rate deals will expire in the second half of this year. Many of these homeowners — especially those coming off five-year deals — could still face significantly higher repayments when they remortgage, depending on market conditions.

How will savings be affected?

Savings rates aren’t directly pegged to the base rate, but many banks and building societies are expected to lower returns on easy-access and variable accounts following the cut.

Before Thursday’s announcement, the average easy-access account paid 2.67%. Some providers were offering far more — with the app Chip at 5.1% and Chase Bank at 5% (both including temporary bonuses).

Those locking money away in fixed-rate bonds still have access to competitive offers. On Thursday morning, the average one-year fixed-rate account paid 3.99%, with top providers such as Union Bank of India (UK) and Vanquis Bank offering 4.47% and 4.44% respectively.

What’s the outlook for new mortgage deals?

Earlier in the year, a mortgage “price war” saw lenders competing aggressively on fixed-rate deals. While the pace of cuts has slowed, rates continue to edge down.

As of Thursday, the average five-year fixed mortgage stood at 5.01% and the average two-year fix at 5%, according to Moneyfacts — both slightly lower than early June’s averages of 5.09% and 5.12%.

Mortgage Market Sees Rates Shift Back to Tradition

For the first time since September 2022, the average two-year fixed mortgage rate has dipped below its five-year equivalent — a reversal that signals a move back toward the long-standing trend where locking in for longer costs more.

At the time of writing, Santander and NatWest were both offering two-year fixes for homebuyers with large deposits at 3.73% and 3.77% respectively. While borrowers coming off ultra-low sub-2% deals will still face a marked jump in repayments, analysts note that the gap is closing. “The payment shock isn’t what it was 12 to 18 months ago,” they say.

Fixed or tracker — which is better right now?

While many analysts still expect further base rate cuts, the Bank of England’s narrow 5–4 vote on Thursday has tempered those predictions. Before the meeting, markets had been pricing in another quarter-point cut this year and a further one by June 2026.

Those expectations shifted after the vote details emerged. Now, forecasts point to the next cut coming by February, with another in November next year. This change in outlook is less encouraging for borrowers hoping for sharp reductions in mortgage rates. Some buyers and remortgagers may opt for a tracker mortgage to take advantage of possible future cuts. However, fixed-rate deals currently have the edge in cost over trackers — while also offering the certainty of locked-in repayments.

The UK housing market has demonstrated resilience, buoyed by robust wage growth, which stood at 5.2% in October, and marginally reduced mortgage rates. The uptick in approved mortgages, surpassing pre-pandemic levels as the year closed, further underscores this strength.

Following two interest rate reductions by the Bank of England in August and November, bringing the rate down to 4.75%, market dynamics were influenced by Rachel Reeves’s autumn budget. The budget’s £40 billion in tax increases has led economists and traders to temper their expectations for future rate cuts, anticipating a slight rise in inflation, which, along with persistent services inflation at 5%, restricts the central bank’s ability to lower borrowing costs further.

Financial markets are currently pricing in two to three additional rate cuts in 2025, potentially reducing the Bank rate to as low as 4% by year-end. According to Robert Gardner, Nationwide’s chief economist, the housing market is expected to maintain its robustness in this environment, though significant growth may be tempered by existing affordability constraints, which are projected to ease gradually.

Gardner noted the potential benefits of lower interest rates and income growth outpacing house price increases, though he cautioned that these factors would require time to significantly impact the market.

Despite recent upticks, mortgage rates have seen some reductions in fixed deals, as highlighted by David Hollingworth, associate director at L&C Mortgages. Current rates stand at 5.46% for two-year fixed mortgages and 5.23% for five-year terms. Earlier offerings below the 4% “psychological threshold,” important for market perception as noted by Tom Bill, head of UK residential research at Knight Frank, have largely vanished, indicating a shift in the lending landscape.

Bill noted, “We’ve firmly established rates above 4% for both two- and five-year fixed mortgages. While certain demographics are compelled to relocate due to factors like schooling and employment, mortgage rates below 4% tend to stimulate additional discretionary buying, which may be slower to rebound.”

He further anticipated that lenders might reduce their mortgage rates in January to attract more business, suggesting, “You may encounter the occasional sub-4% mortgage rate in the first half of the year, but the widespread availability of rates in the three-percent range, similar to what was seen in late summer, is unlikely to be as prevalent.”