Global Capital, Local Impact: Asian Demand in London Property

London Property: The Global Stage for Asian Capital

London’s property market has always been more than bricks and mortar; it is a statement of global connectivity, resilience, and prestige. Despite the shifting tides of geopolitics and economics, it remains a city that investors from Singapore, Hong Kong, Malaysia, and China look to as both a safe haven and a platform for long-term growth. The dynamics of this investment flow are reshaping not only London’s skyline but also its role as a global real estate powerhouse.

A Market in Transition

After a period of subdued growth, London’s prime market is showing early signs of revival. Certain central districts have stabilised, while outer prime areas are beginning to edge upward. Yet the market is evolving in ways that highlight investor pragmatism. A growing number of high-net-worth individuals, particularly from China, are opting to rent in the ultra-luxury segment rather than purchase outright. This shift, driven by increased stamp duties and the end of the non-dom regime, has created an unprecedented surge in luxury rentals, where demand now eclipses supply. London, in this respect, is not just a place to own but a city in which to strategically reside.

Not all areas are enjoying the same momentum. Districts heavily reliant on office-centric living, such as parts of the City, continue to feel the weight of remote working trends, leading to sharper declines in property values. Yet for strategic investors, these cyclical troughs present an opening — assets that today appear discounted may, in the long arc of urban renewal, become tomorrow’s high-performing holdings.

The Asian Investor Footprint

Among international buyers, Asian investors remain the cornerstone of foreign capital flows into London property. Hong Kong stands out as the single largest contributor, supported by the British National (Overseas) visa scheme and the relative affordability of London when compared with one of the most expensive property markets in the world. Singaporean investment has surged, with billions of pounds committed annually. For many Singaporean families, London is both a financial strategy and a lifestyle choice — underpinned by the city’s universities, legal transparency, and enduring global status.

Chinese capital remains deeply embedded in London’s market, not only through individual buyers but also through state-linked funds and corporate entities. These investors view London as a diversification tool, insulating portfolios from domestic volatility while securing a foothold in a market that combines legal stability with international visibility. Malaysia, though smaller in overall volume, continues to play an active role, particularly in commercial and development projects, demonstrating the breadth of Southeast Asian engagement.

Why London, Why Now?

What unites these diverse investor bases is a recognition that London remains undervalued relative to its global peers. Compared to the astronomical costs of ownership in Hong Kong or Shanghai, London offers both value and prestige. The city’s legal system provides certainty, while its global status as a financial hub ensures liquidity and depth of market. The cultural connections — from established expatriate communities to world-class schools and universities — add further weight to the rationale for Asian investors choosing London.

Importantly, the fall of the pound in recent years has created a natural currency hedge, allowing overseas buyers to access prime property at what many perceive as a long-term discount. For investors from Singapore, Hong Kong, Malaysia, and China, this is not simply opportunism but a recognition that London’s fundamentals will continue to deliver returns over decades, not just cycles.

Looking Ahead

The story of Asian investment in London property is not static. As taxes on ownership have risen, so too has creativity in strategy. The ultra-luxury rental market is now a central component of London’s property ecosystem, appealing to global elites who prioritise flexibility without sacrificing prestige. Meanwhile, institutional Asian capital is increasingly targeting commercial property — particularly sustainable grade-A office spaces, which, though currently trading below peak values, represent strong long-term bets.

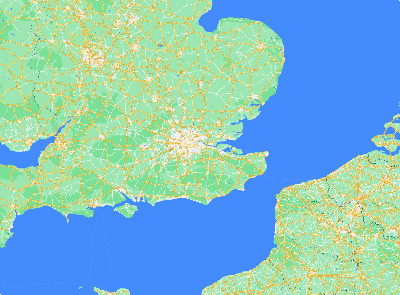

There is also a notable geographic diversification taking place. Investors who once confined themselves to prime central London are now exploring opportunities in regional UK cities. With lower entry points and stronger yields, places such as Birmingham and Manchester are beginning to attract the same Asian capital that once concentrated solely in Mayfair or Knightsbridge.

Conclusion

London’s enduring magnetism lies not only in its heritage but in its adaptability. For investors from Singapore, Hong Kong, Malaysia, and China, it continues to serve as both a shield and a springboard — a shield against uncertainty in their domestic markets, and a springboard into a globally connected, legally sound, and culturally vibrant environment.

As we move through the second half of this decade, one truth remains constant: while markets may fluctuate, London’s place as the epicentre of Asian property investment is secure. The capital is not simply being bought; it is being strategically integrated into the global ambitions of Asia’s wealthiest investors.